Fast Track State Revenue with Instant Sales Tax Collection

Modernizing Sales Tax and Government Revenue Collection

TaxRelay™ is a payment API that empowers businesses and taxing authorities to transparently share data, process payments, and remit tax revenue in real-time.

Fast-Track Government Revenues with Instant Sales Tax Collection

Instant Tax-Remittance

Increased Revenue Collection

Real-time tax remittance and streamlined processing boost revenue efficiently.

Enhanced Fiscal Transparency

Real-time visibility fosters trust, promoting fiscal accountability seamlessly.

Reduced Administrative Burden

By automating sales tax collection, compliance tasks and streamlining workflows, governments can allocate resources more effectively and focus on strategic initiatives rather than manual paperwork

Economic Stimulus

Efficient tax processing through Tax Relay can contribute to economic stimulus by providing governments with timely access to tax revenue. This revenue can be reinvested in public projects and initiatives, creating jobs and stimulating economic growth.

Improved Compliance

With Tax Relay’s automated compliance features, governments can ensure better compliance with tax regulations. By reducing opportunities for tax evasion and fraud, Tax Relay strengthens enforcement efforts, leading to a fairer and more equitable tax system.

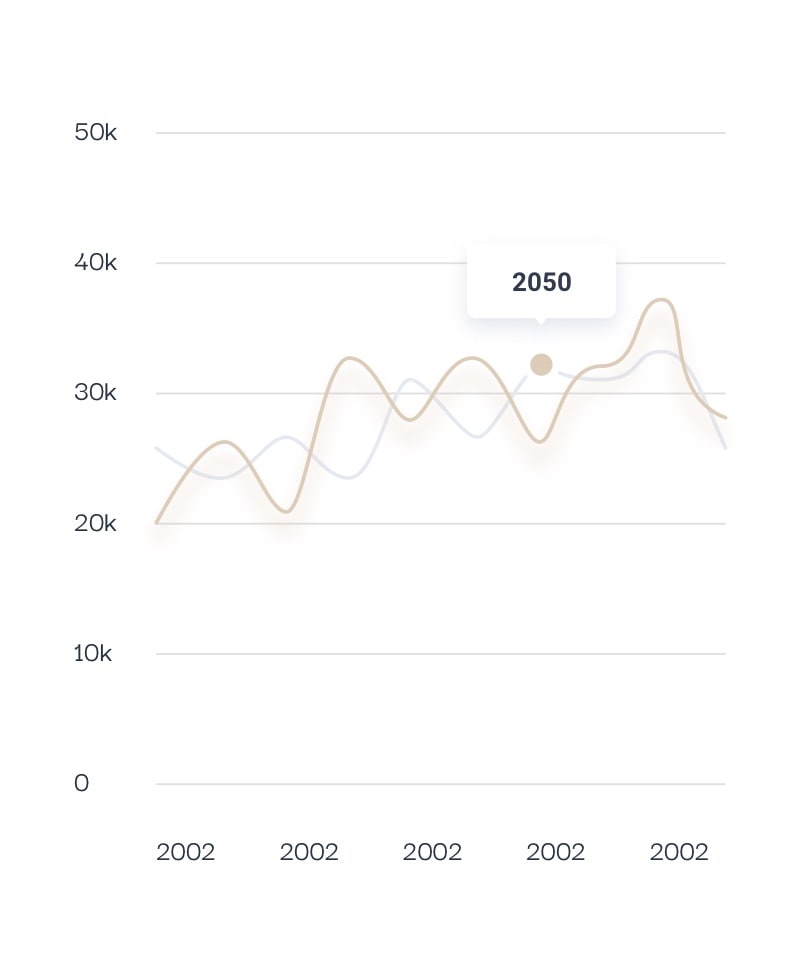

The Future of Revenue Collection

In a traditional sales tax payment lifecycle, it can take 30, 60, 90 days, sometimes a full year before sales tax revenue is remitted and has actually been disbursed downline to the final State entity. This slow moving process results in a lot of locked up cash that could be otherwise utilized. Tax Relay is speeding up this process to fully execute in real-time.

Future

Address

Tax Relay

120 N. Main St

Saint Charles, MO 63301